Corporate Governance

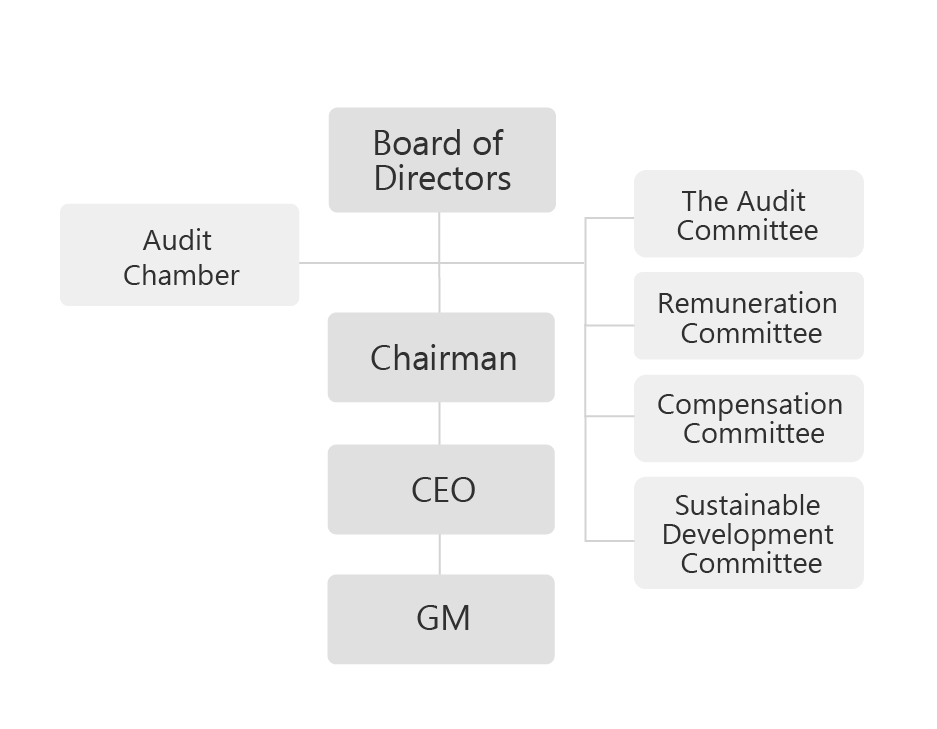

Corporate Governance Structure

The Company has passed a resolution on 2020/05/11 board meeting and has appointed competent and appropriate corporate governance personnel. The Company has established full-time financial officer, Huang, Je-Wen as responsible for corporate governance related matters. Huang has accumulated over three years of financial manager expertise and experience.

The company has established a Chief Corporate Governance Officer who meets the eligibility requirements before the release of “Taipei Exchange Directions for Compliance Requirements for the Appointment and Exercise of Powers of the Boards of Directors of TPEx Listed Companies”and completed 12 hours of training hours in 2022.

Operational performance in 2023 was as follows:

- Regularly informing the Board of Directors of the latest changes and developments of laws and regulations related to the Company’s business field and corporate governance.

- Handling the operation of the Board of Directors and the functional committees according to laws.

- Planning and implementing the director education courses.

- Insurance and maintenance of directors liability insurance.

- 2023 performance evaluation of the Board of Directors shall be carried out in accordance with the “Performance Evaluation Method of the Board of Directors” established by the Company.

- Responsible for all matters related to the shareholders’ meeting.

- Reviewing the achievement of corporate governance evaluation indicators and proposing the improvement plans and countermeasures for the indicators that are not achieved.

Preventing insider trading education promotion

The Company hosts educational awareness training pertaining to “Prevention of Insider Trading”,”Corporate Govemance Best Practice Principles” and relevant regulations at least once a year. Newly appointed directors and managers will be scheduled for these courses respectively. The Company’s current directors and management has undertaken the aforementioned education training on June 13, 2023. The course includes non-disclosure related issues regarding material information, the definition of insider trading, and case studies.

Internal Audit

PSC’ Internal Audit function is an independent unit that reports directly to the Board of Directors. Besides informing the Board during its ordinary meetings, it briefs the Chairman and the General Manager on a monthly and on as needed basis. There are two full time employees dedicated to Internal Audit, including the Internal Auditing Officer and audit representative.

PSC has established and carries out “internal control systems” according to the Regulations Governing Establishment of Internal Control Systems promulgated by the Securities and Exchange Act.

The majority of the audit work is executed according to an annual plan. Special audits or reviews are conducted as needed. The combination of the regular audits and the special projects provide management with feedback on the functioning of the internal control system.

Board Operation

The Company has 5 to 9 directors, adopting a nomination system for candidates, which will be selected by the shareholders’ meeting for the list of candidates for a three-year term and the same person may be re-elected upon expiry of the term, however, according to Article 14-2 of the Securities and Exchange Act. The above number of board of directors shall include at least 3 independent directors and no less than one-fifth of the numbers of board of directors.

Member of Board of Directors

| Title | Name | Date Appointed | Term | Education / work experience | Other positions at the Company or elsewhere |

|---|---|---|---|---|---|

| Chairperson and CEO | Cheer Du | 2021.7.22 | 3 Year | Department of Economics, National Taiwan University | Chairperson, Guang Mai industrial Ltd. |

| Director, Chuang Feng investment Co., Ltd. | |||||

| Chairperson, Promate Solutions Co., Ltd. | |||||

| Chief Operating Officer, Promate Electronic Co., Ltd. | |||||

| Directors | Promate Electronic Co., Ltd. (Representative:Eric Chen) | 2021.7.22 | 3 Year | Bachelor of Science in Electrophysics, National Chiao Tung University, Taiwan | Chairperson, Chuang Feng investment Co., Ltd. |

| Director, Promate Solutions Co., Ltd. | |||||

| Engineer, Texas Instruments Inc | Chairperson, Promate Electronic Co., Ltd. | ||||

| Director, Weikeng Industrial Co., Ltd. | |||||

| Directors | Promate Electronic Co., Ltd. (Representative:Ciou-Jiang HU) | 2021.7.22 | 3 Year | Master of Business Administration, Da-Yeh University, Taiwan | President, Weikeng Industrial Co., Ltd. |

| Bachelor of Science in Communications Engineer, National Chiao Tung University, Taiwan | Chairman, Weiji Investment Co., Ltd. | ||||

| Chairman, Weikeng International Co., Ltd. | |||||

| Chairman, Weikeng Technology Pte Ltd. | |||||

| Executives Program, Graduate School of Business Administration, National Cheng-Chi University | Chairman, Weikeng Technology Co., Ltd. | ||||

| Independent Director & Remuneration Committee, V-TAC Technology Co., Ltd. | |||||

| Independent Director, Remuneration Committee, and Audit Committee, CIPHERLAB Co., Ltd. | |||||

| Director, Promate Electronic Co., Ltd. | |||||

| Ph.D. of Institute of Management of Technology, National Chiao Tung University, Taiwan | Director(Representative of Juristic Person/ Promate Electronic Co., Ltd.), Promate Solutions Co., Ltd. | ||||

| Director, Amazing Microelectronic CO., Ltd. | |||||

| Supervisor, LEADTEL Co., Ltd. | |||||

| Supervisor, EVGA Technology Incorporated | |||||

| Directors | Liu-Ping Chen | 2021.7.22 | 3 Year | Department of Management Information System,Chung Yu University of Film and Arts | – |

| Financial Manager , Wellmark Investment Co., Ltd. | – | ||||

| Independent Director | Ying-Min Zhong | 2021.7.22 | 3 Year | Department of Economics,Soochow University,Taiwan | – |

| Financial Manager, Applied Materials Taiwan | – | ||||

| Independent Director | Mau-Shiung Chen | 2021.7.22 | 3 Year | Department of Economics, National Taiwan University | – |

| Executive Master of Business Administration, University of Houston | – | ||||

| General Manager of IBM’s Greater China Telecom and Media Business Group. | – | ||||

| Deputy General Manager, International Integrated Systems Inc. | – | ||||

| Independent Director | Yue-Xiu Liu | 2021.7.22 | 3 Year | Master of Electrical Engineering, National Taiwan University | – |

| Electrical Engineering, Tamkang University,Taiwan | – | ||||

| Technical Manager, Novatek Microelectronics Corp. | – | ||||

| Independent Director | Han-Liang Hu | 2022.6.14 | 3 Year | Master of Accounting and Business Administration, National Taiwan University | CPA, C.J.S. CPAS & Co. |

| Certified Public Accountant of R.O.C. | Director, Kun Ying enterprise Co., Ltd. | ||||

| Independent Director, Hermes Microvision, Inc. | Director, Ke Cheng Co., Ltd. | ||||

| Supervisor, United Way of Taiwan | Director, Sin Yun enterprise Co., Ltd. | ||||

| Supervisor, Orient Pharma Co., Ltd. | |||||

| Chairperson, Algoltek, Inc. | |||||

| Director, Jian Ruei venture capital Ltd. | |||||

| Director, Basecom Telecommunication Co., Ltd. | |||||

| Director, ACCOMP TECHNOLOGIES CO., LTD. | |||||

| Supervisor, Get Green Energy Co., Ltd. | |||||

| Independent Director, Episil-Precision Inc. |

註:威健實業股份有限公司總經理 威記投資股份有限公司董事長 威健實業國際有限公司董事長 Weikeng Technology Pte Ltd. 董事長 威健資通股份有限公司董事長 研通科技股份有限公司獨立董事/薪酬委員 欣技資訊股份有限公司獨立董事/薪酬委員/審計委員 豐藝電子股份有限公司董事 勁豐電子股份有限公司董事(所代表法人: 豐藝電子股份有限公司) 晶焱科技股份有限公司董事 麗臺科技股份有限公司董事 艾維克科技股份有限公司監察人

相關之董事進修情形,請詳「公開資訊觀測站」

Diversity of Board Members

Pursuant to the Company’s “Corporate Governance Principles,” the composition of the Board of Directors should take into consideration the policy of diversity. Directors who serve concurrently as the Company’s managers should not exceed one third of all Directors and appropriate diversification guidelines have been established based on Company operations, its business model, and development requirements. These guidelines stipulate that Directors should be assessed by standards including but not limited to the following two aspects:

A. basic qualifications and value: gender and age;

B. Professional knowledge and skills: professional background, competencies, and industry experiences etc as follows:

1. Ability to make sound business judgments.

2. Accounting and financial analysis capability.

3. Ability to manage a business.

4. Ability to respond to a crisis.

5. Industry knowledge.

6. An understanding of international markets.

7. Leadership

8. Decision-making capability

| Title | Name | Gender | Age | Ability to make sound business judgments | Accounting and financial analysis capability | Ability to manage a business | Ability to respond to a crisis | Industry knowledge | An understanding of international markets | Leadership | Decision-making capability |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Chairman and CEO | Promate Electronic Co., Ltd. (Representative : Cheer Du) | Female | 67 | V | V | V | V | V | V | V | V |

| Director | Promate Electronic Co., Ltd. (Representative : Eric Chen) | Male | 70 | V | V | V | V | V | V | ||

| Director | Promate Electronic Co., Ltd. (Representative : Ciou-Jiang HU) | Male | 69 | V | V | V | V | V | V | V | V |

| Director | Liu-Ping Chen | Female | 67 | V | V | V | V | V | V | V | V |

| Independent Director | Ying-Min Zhong | Female | 67 | V | V | V | V | V | V | V | V |

| Independent Director | Mau-Shiung Chen | Male | 62 | V | V | V | V | V | V | V | |

| Independent Director | Yue-Xiu Liu | Male | 46 | V | V | V | V | V | V | V | |

| Independent Director | Han-Liang Hu | Male | 55 | V | V | V | V | V |

Independent Directors’ Communication with Internal Auditor and Certified Public Accountant (CPA)

I. Communication methods

1. The head of internal auditor and independent directors meet at least once a quarterly regular meeting to report on the company’s internal audit execution status, internal control operations and the execution of Audit Committee Letter; meetings can be convened at any time if there are major events.

2. Independent directors and accountants meet at least twice a year regular meeting. Accountants report on the results of quarterly financial statement reviews or verifications and other communication requirements required by relevant laws and regulations. Communications will be made on whether there are any significant adjustment entries or legal amendments affecting the accounting situation and they also regularly update laws and ordinances to independent directors every year. Independent directors also conduct independent assessments of the services provided by accountants. If there are major events, a meeting can be convened at any time.

II. The communication situation is as the attached:

1.Communication between Independent Directors and Accountants is appropriate

Date | Focus on | Results |

2023.12.11 | Accountant’s explanation and communication on 2023 Year Individual and Consolidated Financial Statements in terms of pre-audit planing, key audit events and operating performance analysis | All of above matters were reviewed and approved by the Audit Committee whereupon independent directors raised no objection. |

2023.08.04 | Communication regarding the approved 2023 Q2 consolidated financial statements with the CPA. | All of above matters were reviewed and approved by the Audit Committee whereupon independent directors raised no objection. |

2023.06.13 | Discussing Shareholders’ Meeting Agenda | All of above matters were reviewed and approved by the Audit Committee whereupon independent directors raised no objection. |

2023.05.08 | Communication regarding the approved 2023 Q1 consolidated financial statements with the CPA | All of above matters were reviewed and approved by the Audit Committee whereupon independent directors raised no objection. |

2023.03.14 | Major findings from the CPA’s audit of the Company’s 2022consolidated financial reports(including journal entry adjustment and material weaknesses in internal control), the subsequent audit report was submitted to the meeting for discussion. | All of above matters were reviewed and approved by the Audit Committee whereupon independent directors raised no objection. |

2. Communication between Independent Directors and Internal Audit Manager is appropriate

| Date | Focus on | Results |

| 2023/12/11 | ●2023Q4 Presentation of audit report. | No major lack of internal control and abnormal events. |

| ●Discussion on the Company’s internal audit plan for 2024 | ||

| 2023/8/4 | ●2023Q3 Presentation of audit report. | No major lack of internal control and abnormal events. |

| 2023/6/13 | ●2023Q2 Presentation of audit report. | No major lack of internal control and abnormal events. |

| 2023/3/14 | ●2023Q1 Presentation of audit report. | No major lack of internal control and abnormal events. |

| ●Internal Control System Statement for 2022. |

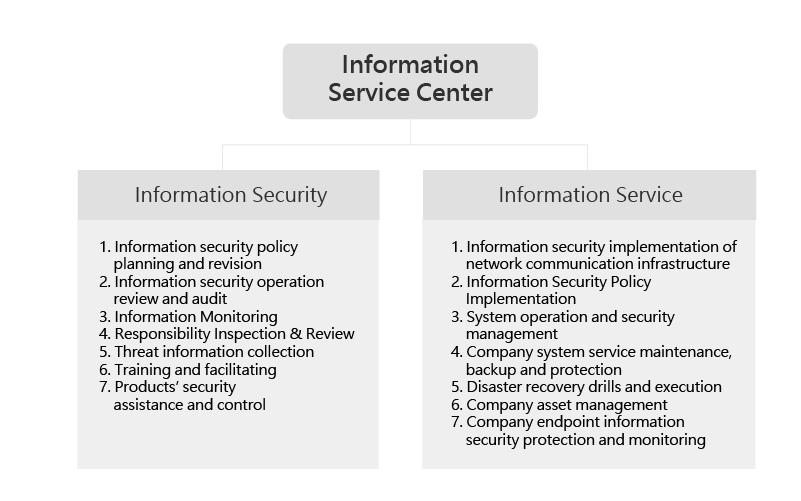

I.Organizational structure of information security

Security Management Policy

Purpose: To strengthen information security management, Promate Electronic Co., Ltd. establishes safe and reliable electronic communications that ensure data confidentiality, system integrity and process management, in addition to equipment and network security. This avoids unnecessary operational losses caused by information security failures so as to ensure the purpose of continuous business operations.

III.Information Security Management Measures

| Type | Relevant Operations | |||

|---|---|---|---|---|

| Access Management | 1. Review of personnel account access management | |||

| 2. Regular inventory of personnel accounts | ||||

| 3. Strengthen employees’ awareness of information security and information security education and training | ||||

| Control and Management on System Access | 1. Management measures of personnel access to internal/external systems and data transmission | |||

| 2. Separating the internal/external network with a firewall | ||||

| 3. Remote access management measures | ||||

| External Threats | 1. Program for computer virus protection and regular virus pattern updates | |||

| 2. Regular vulnerability scans | ||||

| 3. If the information system is infected by a virus, security vulnerabilities and exploits shall be protected | ||||

| 4. E-Mail security, Spam mail filtering mechanism | ||||

| Availability | 1. Network and system usage status monitoring and reporting mechanism | |||

| 2. Contingency measures when information services are interrupted | ||||

| 3. Ensure the implementation of daily backup/remote backup mechanisms and store them in a secure location | ||||

| 4. Data leakage prevention mechanism to ensure data confidentiality | ||||

| 5. Regular disaster recovery drills so that the computer systems and business can quickly resume to normal operations after a disaster occurs | ||||

The Audit Committee

The Audit Committee of the Company (the Audit Committee), composed of all three of the independent directors, has been established in order to enhance the corporate governance, to refine the internal audit and to strengthen the management. The purpose of the Audit Committee is to help the Board of Directors execute its responsibility in supervision on such categories as the financial statements, the audit and accounting policy and procedure, the internal control code and other major items as stipulated by related companies or the regulatory authorities.

The Company’s Audit Committee was set up in July 2016. The Audit Committee shall faithfully carry out the following duties and submit any proposals to Board of Directors meeting for discussions.

1. The adoption of or amendments to the internal control system pursuant to Article 14-1 of the Securities and Exchange Act.

2. Assessment of the effectiveness of the internal control system.

3. The adoption or amendment, pursuant to Article 36-1 of the Securities and Exchange Act, of the procedures for handling financial or business activities of a material nature, such as acquisition or disposal of assets, derivatives trading, loaning of funds to others, and endorsements or guarantees for others.

4. Matters in which a director is an interested party.

5. Asset transactions or derivatives trading of a material nature.

6. Loans of funds, endorsements, or provision of guarantees of a material nature.

7. The offering, issuance, or private placement of equity-type securities.

8. The hiring or dismissal of a certified public accountant, or their compensation.

9. The appointment or discharge of a financial, accounting, or internal audit officer.

10.Annual and semi-annual financial reports.

11.Other material matters as may be required by this Corporation or by the competent authority.

12.The Audit Committee performance evaluation.

Members of the Audit Committee

| Title | Name | Notes |

|---|---|---|

| Independent Director | Ying-Min Zhong | Convener |

| Independent Director | Mau-Shiung Chen | – |

| Independent Director | Yue-Xiu Liu | – |

| Independent Director | Han-Liang Hu | – |

• Periodically review these procedures and propose any amendments.

• Set and regularly review annual and long-term performance goals and salary compensation policies, systems, standards and structure of the Company’s directors, supervisors, and managers.

• Assess the performance objectives of the Company’s directors, supervisors and managers on a regular basis to determine the items and amount of compensation for them.

The Committee shall perform the duties under the preceding paragraph in accordance with the following principles:

1. Ensuring that the compensation arrangements of this Corporation comply with applicable laws and regulations and are sufficient to recruit outstanding talent.

2. Performance assessments and compensation levels of directors, supervisors, and managerial officers shall take into account the general pay levels in the industry, individual performance assessment results, the time spent by the individual and their responsibilities, the extent of goal achievement, their performance in other positions, and the compensation paid to employees holding equivalent positions in recent years. Also to be evaluated are the reasonableness of the correlation between the individual’s performance and this Corporation’s operational performance and future risk exposure, with respect to the achievement of short-term and long-term business goals and the financial position of this Corporation.

3. There shall be no incentive for the directors or managerial officers to pursue compensation by engaging in activities that exceed the tolerable risk level of this Corporation.

4. For directors and senior managerial officers, the percentage of remuneration to be distributed based on their short-term performance and the time for payment of any variable compensation shall be decided with regard to the characteristics of the industry and the nature of this Corporation’s business.

5. No member of the Committee may participate in discussion and voting when the Committee is deciding on that member’s individual compensation.

Members of the Remuneration Committee

| Title | Name | Notes |

|---|---|---|

| Independent Director | Mau-Shiung Chen | Convener |

| Independent Director | Ying-Min Zhong | – |

| Independent Director | Yue-Xiu Liu | – |

Nominating Committee

To ensure the soundness of the board and strengthen the management mechanism of this Company, PSC established “Nominating Committee” in June 2022.

With authorization from the board of directors (below, “the board”), the Committee shall exercise the due care of a good administrator to faithfully perform the following duties and shall submit its proposals to the board for discussion:

- Laying down the standards of independence and a diversified background covering the expertise, skills, experience, gender, etc. of members of the board, supervisors and senior executives, and finding, reviewing, and nominating candidates for directors, supervisors, and senior executives based on such standards.

- Establishing and developing the organizational structure of the board and each committee, and evaluating the performance of the board, each committee, and each director and senior executive and the independence of the independent directors.

- Establishing and reviewing on a regular basis programs for director continuing education and the succession plans of directors and senior executives.

- Establishing corporate governance guidelines of the Company.

If a member of the Committee has a stake in performing the duties in the preceding paragraph, he/she shall state the important aspects of its stake in the meeting of the Committee concerned, and where there is a likelihood that the interests of this Company would be prejudiced, he/she may not participate in discussion or voting, shall recuse himself/herself from any such discussion and voting, and may not exercise voting rights as proxy on behalf of another member of the Committee.

To decline to adopt a recommendation of the Committee, the board of directors shall require the agreement of a majority of the directors in attendance at a meeting attended by two-thirds or more of all of the directors. In such event, the Company shall specify the details and cause of the discrepancy in the board meeting minutes, and within two days counting inclusively from the date of the board meeting resolution, shall furthermore carry out public announcement and reporting on the Market Observation Post System.

Members of the Nominating Committee

| Title | Name | Notes |

|---|---|---|

| Independent Director | Mau-Shiung Chen | Convener |

| Independent Director | Ying-Min Zhong | – |

| Independent Director | Yue-Xiu Liu | – |

ESG Committee

For the implement of sustainability, PSC established “ESG Committee” in June 2022 to propose and enforce the corporate social responsibility policies, systems (or relevant management guidelines), and concrete promotional plans.

In order to assist the Board of Directors to continuously promote corporate social responsibility and improve corporate governance for the purpose of practicing sustainable management, the authority of ESG Committee should include the following:

- To formulate corporate social responsibility, sustainable development direction and goals, and formulate relevant management policies and specific promotion plans.

- To promote and implement the Company’s integrity management and risk management and other related work.

- To track, review, and revise the implementation and effectiveness of the Company’s sustainable development.

- Other matters to be performed by the Committee pursuant to the resolution of the Board of Directors.

Members of the ESG Committee

| Title | Name | Notes |

|---|---|---|

| Chairperson | Cheer Du | Convener |

| Independent Director | Mau-Shiung Chen | – |

| Independent Director | Han-Liang Hu | – |

Ethical Management Practices

Implementation of Ethical Corporate Management and Deviations from the “Ethical Corporate Management Best-Practice Principles for TWSE/TPEx Listed Companies” and Reasons

2023.12.11 Resolution by the board of directors

| Evaluation Item | Implementation status | Deviations from the “Ethical Corporate Management Best Practice Principles for TWSE/TPEx Listed Companies” and Reasons |

|---|---|---|

| I. Establishment of ethical corporate management policy and approaches | ||

| (I) Did the company establish an ethical corporate management policy that was approved by the Board of Directors, and declare its ethical corporate management policy and methods in its regulations and external documents, as well as the commitment of its Board and management to implementing the management policies? | (I) The Company has a “Code of Ethical Operation” established by the Board of Directors, which applies to the companies and organizations in our group. It is strictly implemented in our internal management and external business activities. | No difference |

| (II) Does the company establish mechanisms for assessing the risk of unethical conduct, periodically analyze and assess operating activities within the scope of business with relatively high risk of unethical conduct, and formulate an unethical conduct prevention plan on this basis, which at least includes (II) Does the company establish mechanisms for assessing the risk of unethical conduct, periodically analyze and assess operating activities within the scope of business with relatively high risk of unethical conduct, and formulate an unethical conduct prevention plan on this basis, which at least includes? | (II) The companies and organizations in our group conduct the mentioned matters following the relevant provisions and operating procedures stipulated in the corporation’s “Code of Ethical Operation.” | No difference |

| (III) Did the company specify operating procedures, guidelines for conduct, punishments for violation, rules of appeal in the unethical conduct prevention plan, and does it implement and periodically review and revise the plan? | (III) To enhance the management of ethical operations, the Company has set up a dedicated unit under the Board of Directors, allocating sufficient resources and qualified personnel to it. It is responsible for the formulation and supervision of ethical management policies and precautionary measures. It primarily administers the following affairs and regularly reports to the Board of Directors (at least once a year): | No difference |

| II. Implementation of ethical corporate management | ||

| (I) Does the company evaluate the ethical records of parties it does business with and stipulate ethical conduct clauses in business contracts? | (I) Contracts signed between the Company and suppliers or manufacturers are performed in good faith. Generally, there are provisions in place that prohibit the receiving of kickbacks. | No difference |

| (II) Did the company establish a dedicated unit under the Board of Directors to promote ethical corporate management, and periodically (at least once a year) report to the Board of Directors and supervise the implementation of the ethical corporate management policy and unethical conduct prevention plan? | (II) The Company has set up a dedicated (part-time) unit under the Board of Directors to implement ethical corporate management. It regularly reports to the Board of Directors regarding its operation. The primary focus when it comes to the promotion of company managers and the appointment of employees is their integrity records, and these are one of the focal points in the consideration for promotions. On December 11, 2023, the Board of Directors completed the 2023 annual reporting on the implementation of ethical management. | No difference |

| (III) Does the company establish policies to prevent conflict of interests, provide appropriate channels for filing related complaints and implement the policies accordingly? | (III) The Company has a “Code of Ethical Operation” and “Code of Moral Conduct” to prevent conflicts of interest and avoid personal gain. | No difference |

| If the directors or their legal representatives have a stake in the motions set forth by the Board of Directors, the shall disclose the nature of their interest and not be included in the related discussion or vote on the said motion, or represent other directors in exercising their voting rights. | ||

| (IV) Does the company have effective accounting system and internal control systems set up to facilitate ethical corporate management, does the internal auditing unit formulate audit plans based on unethical conduct risk assessment results, and does it audit compliance with the unethical conduct prevention plan or commission a CPA to perform the audit? | (IV) The accounting system of the Company is based on the Securities and Exchange Act, the Company Act, the Business Entity Accounting Act, the Regulations Governing the Filing of Financial Reports by Public Companies, and other relevant legislation, then devised according to the actual situation of the company’s business; the internal control system is based on the “Regulations Governing the Establishment of Internal Control Systems by Public Companies” and other relevant regulations, which are all thoroughly implemented. The audit department also regularly examines the status of the accounting system and internal control system and reports to the Board of Directors. | No difference |

| (V) Does the company regularly hold internal and external educational trainings on ethical corporate management? | (V) The Company periodically organizes promotions and training on ethical management at appropriate times. | No difference |

| III. Operation of whistleblowing system | ||

| (I) Does the company establish concrete whistleblowing and reward system and have a convenient reporting channel in place, and assign an appropriate person to communicate with the accused? | (I) The Company has “Employee Work Rules” and “Reporting System Management Measures,” which clearly stipulates the relevant content, and will assign designated personnel to handle each of the reported cases. | No difference |

| (II) Does the company establish standard operating procedures for investigating reported cases, and does it take subsequent measures and implement a confidentiality mechanism after completing investigation? | (II) The Company has relevant employee reporting procedures in place, along with confidentiality mechanisms. | No difference |

| (III) Does the company provide proper whistleblower protection? | (III) Designated personnel will be appointed to handle each of the reported cases. During the appeal process, the informant will be protected from improper punishment due to the reporting. | No difference |

| IV. Enhancing information disclosure | ||

| Does the company disclose information regarding the company’s ethical corporate management principles and implementation status on its website and the Market Observation Post System? | The Company has established the “Code of Ethical Operation” to enhance the management of ethical operations and placed it on our company website. With the chairman’s office as a designated unit, we allocate sufficient resources and qualified personnel to it. It is responsible for the formulation and supervision of ethical management policies and precautionary measures and regularly reports to the Board of Directors (at least once a year). At the same time, we set up a designated area for stakeholders on our website, establishing a communication platform. In 2023, no illegal, unethical, or untrustworthy conduct has been reported. | No difference |

| V. If the company has established Ethical Corporate Management Principles in accordance with “Ethical Corporate Management Best Practice Principles for TWSE/GTSM Listed Companies,” describe difference with the principles and implementation status: | ||

| The Company established the “Ethical Corporate Management Best Practice Principles” to establish a corporate culture of ethical management and to achieve sound development. There is no deviation between actual operations and the Company’s Best Practice Principles. | ||

| VI. Other important information to facilitate a better understanding of the company’s implementation of ethical corporate management:In addition to the “Code of Ethical Operation,” the Company also establishes relevant regulations of ethical management in the contracts with manufacturers. Employees are also required to adhere to the code of ethical conduct when they take up their posts. In 2023, the Company held internal and external education training with a collective attendance of 11 people for a total of 93 hours (the scope covers compliance with ethical management, the accounting system, and the internal control system). | ||